The Input Section

📗Importance of this section

This is the section the governs the entire Financial Model and makes the model precise to your business and your plan. one thing is for sure, the quality and accuracy of a financial model are heavily dependent on the inputs used. Financial models are used for decision-making, forecasting, and valuation. If the inputs are flawed or unrealistic, the outputs will be misleading, leading to poor decisions. Financial Models are not an exact science, they are directional so the inputs are completed with what we know and expect today so it is also important to regularly review and update these inputs to reflect changes in the economic environment or business operations.

We find that there is one golden rule to follow:

The assumptions in a financial model need to be realistic and justifiable

Assumptions about market growth, inflation rates, or interest rates have a significant impact on projections. Overly optimistic or pessimistic assumptions can lead to skewed outcomes, affecting investment decisions and strategic planning BUT assumptions are exactly that - assumptions - we do not have a crystal ball but it is important to balance realism with ambition. If you are looking to use the Financial Model to secure funding, it is often good to have a narrative that sits behind the critical assumptions perhaps size of market, perhaps a USP either way, give the assumptions some real thought.

So with that said, let's jump into it.

📗Structure of the input section

The model is dynamic so any update to the inputs will automatically update the model and the model outputs. The Input section is the second section of the model and is a list of clearly labelled assumptions to drive the model - please note the guidance and the unit value - to get that most accurate outputs, please ensure that you are using the correct units. Always look at the column headings as we have assumptions that fall into three time frames:

- Annual assumptions - Assumptions that can be modified on annual basis and these assumptions are generally representing the average, in other words, it is the average salary in that model year or the average price charged. To complete these, it is important to think about the growth in the assumption from Year 1 to Year 2, Year 2 to Year 3, etc. - these assumptions will look like this:

- Model wide assumptions - An assumption that run through out the entire model period, remember in the 1 Page Financial Models we are considering a 5 year time frame. For the multi-year projections, consider the compounding effect of inflation and potential changes in taxation rates. - these assumptions will look like this:

- Funding round assumptions- In the 1 Page Financial Models, you can map up to 3 finance rounds. Accordingly, we have funding round specific assumptions which look like this:

📗Completing the inputs

Let's take each section in turn:

📈General & Market

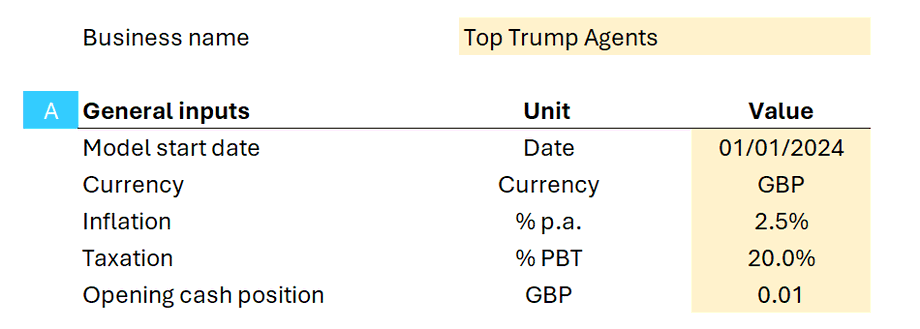

This section give the model an the market based assumptions e.g. inflation as well as some key fundamental parameters such as the model start date - note these are all "Model wide" inputs:

-

Model Start Date

- This date signifies the commencement of the financial projections. All calculations, including cash flows, revenues, and expenses, will start from this date. Ensure that all historical data leading up to this date is accurate and complete.

-

Currency

- All financial transactions, balances, and statements should be calculated and presented in (in this case) GBP.

-

Inflation

- This annual rate should be applied to project future costs and prices. It's essential to factor in inflation for long-term projections to maintain the model's accuracy over time. Review and update this rate annually or as market conditions change.

-

Taxation

- Apply this tax rate to the calculated profit before tax to determine the tax expense. This input is crucial for accurate net profit calculations. Stay updated with tax legislation as changes can significantly impact financial outcomes.

-

Opening Cash Position

- This nominal amount represents the initial cash balance. It's a placeholder and should be updated with the actual opening cash balance when the model goes live. Ensure that this figure is reconciled with the company's actual financial statements.

💵Revenue Drivers

So we are in business to drive Revenue which should drive profits and returns. In this section of the inputs, we look at the fundamental key drivers for the specific 1 page Financial Model selected. It is worth noting that in most cases the revenue is driven by Volume x Price, so this section looks to determine those two parameters. In each 1 page Financial Model, we also include "other" revenue to capture all - i.e. other revenues your business is forecasting outside the core template revenues. These are assumptions will be generally "Annual assumptions" so you have the option to be quite precise on the year on year inputs. The section will look as per the below:

In the above example, the volume is the average number of projects and the price is the average commission charged on the average value of the project but note, this section will reflect the 1 page Financial Model that you have purchased.

⚒️Cost Drivers

The Cost Drivers is where we begin to see some representations of the Income Statement. This section splits the costs out in terms of Variable Costs (Costs of Goods Sold), team costs (after all, it will be a team effort!!) and the more fixed overheads. Once we have these and the Revenue, the 1 page Financial Model can output the EBITDA or Operating Profit a critical Financial Health and Efficiency KPI. So let's split into the sections:

-

Variable Costs

- These are the costs that deliver the revenue, so they are only expended in revenue is generated, we therefore use a % of the revenue as the key driver. An example would be, in a Bakery and the cost of flour, sugar, and other ingredients varies directly with the quantity of baked goods produced. More production means higher raw material costs, making them variable expenses. These assumptions look like below (note in our 1 page Financial Models you can completely bespoke them for your business):

-

Team Costs

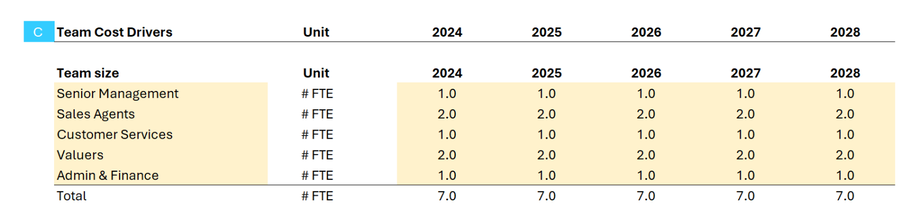

- These are the costs that deliver the revenue, so they are only expended in revenue is generated, we therefore use a % of the revenue as the key driver. An example would be, in a Bakery and the cost of flour, sugar, and other ingredients varies directly with the quantity of baked goods produced. More production means higher raw material costs, making them variable expenses. These assumptions look like below (note in our 1 page Financial Models you can completely bespoke them for your business):

- The key formula for working out the cost of the team is the average salary for the category x the number of FTE for the category BUT we need to remember that there are further costs to the business in terms of taxes and benefits so the wage bill is increased by a set % to cover these costs and reflect reality. The team size is driven by "FTE" - Full time Equivalent - so if someone is fulltime they are 1, if someone works 2.5 days a week they would 0.5. This is done for each category of staff (again, bespoke to your business) and on an annual basis to reflect growth in the team.

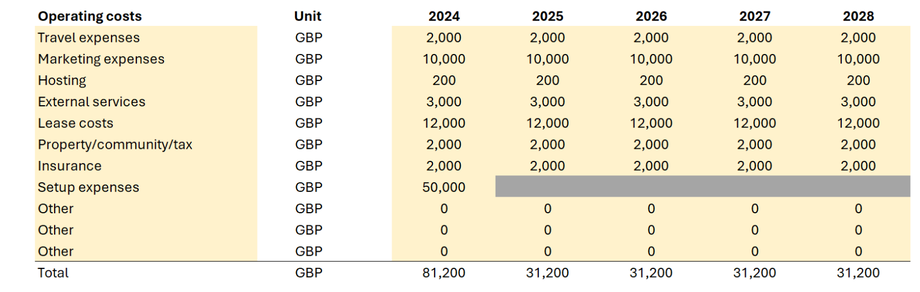

- Overheads

- These are the fixed costs (or overheads) and bespoke to your business. These are "Annual assumptions" so you can reflect growth in the costs, in line with growth in the business but remember that we inflate the prices (both revenue and costs) already. You can rename each overhead (as it is yellow!) to reflect you business. Overhead inputs look like the below:

🏷️Capital Spend

When completing the inputs, one of the key areas to focus on is corporate spending, particularly capital investments. Understanding and accurately inputting this data is crucial for the model to reflect the financial health and future projections of a business. By Capital Spend, we refer to the money a company spends to buy, maintain, or improve its fixed assets, such as buildings, vehicles, equipment, or land. In your model, there are five different capital investments listed for each year. You can also add the type of capital investment that it is e.g. Vehicles or Premises. Note that these are Annual Assumptions.

There is also a Model Wide Assumption, the "Average life of assets" - this is the useful life of the asset and enables the model to calculate the depreciation which is the degradation of asset value through wear and tear and important for the Income Statement and forecasting an accurate asset valuation.

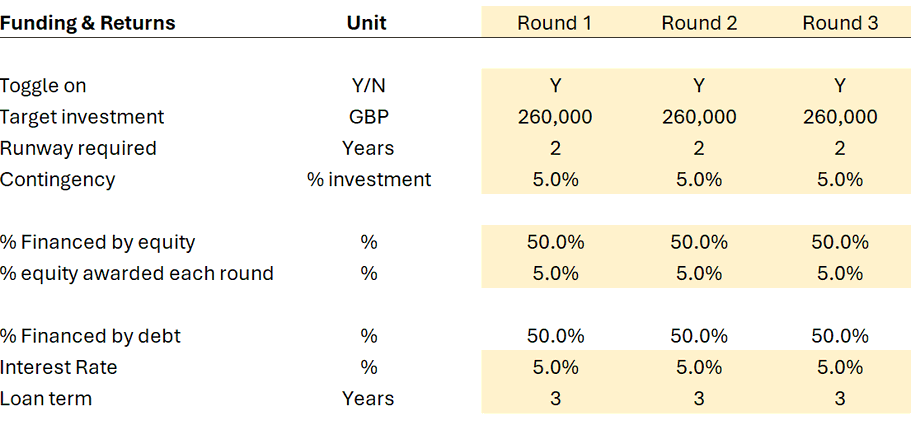

🔢Funding & Returns

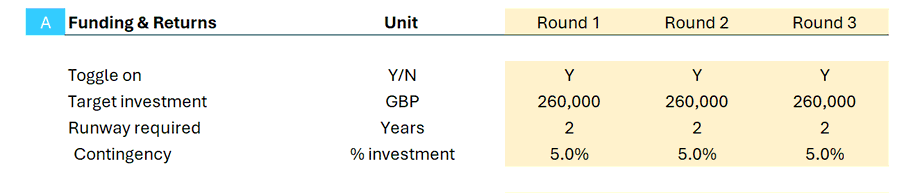

Now we get onto the financing assumptions and the first Funding round base assumptions - where the assumptions are split by funding round.

Here you can toggle investment rounds on and off by using the Y/N and then you can input the amount that you think you need to raise which can then be split into equity and debt - you can update this by entering what % of the funding will be equity (the debt portion will automatically calculate). You can also select the timing of the investment i.e. which model year and also the "Runway" which is a start up world term for how long the investment needs to last given your cost base, this is again in Years. We also recommend that you include some contingency funding to ensure that there is no cash shortfalls should there be delays or other unforeseen issues with the plan.

If there is a portion that is equity, the you will need to input the equity awarded in the round - this amount of the % equity ownership the investor will be awarded of the company.

If there is a debt portion, then you will need to enter the interest rate and the term of the loan. The model takes a simplistic view on loans that there are equal annual repayments each year and interest is paid on any outstanding loan in the company until all is paid back.

The model will calculate from your inputs the funding you need and will show you have short or over you are of that investment need.

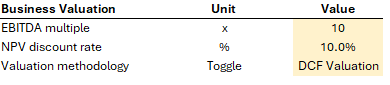

🌟Business Valuations

Business valuation is a critical process in finance, used to estimate the economic value of an owner’s interest in a business. This valuation is often necessary for financial reporting, taxation, and transactional purposes. Let's explore how to complete the inputs for a business valuation in a financial model and understand their importance.

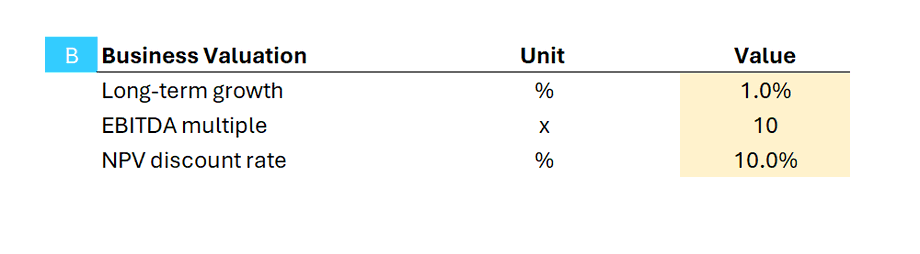

The 1 page Financial Model uses two valuation methods to get an "Enterprise Value" and these are the inputs that we need. The two methods are as follows

- EBITDA multiple - This is using a market validated "multiple" to multiply the EBITDA. The market validated is by using comparisons in the market of similar transactions so if this multiple was 10x and the EBITDA was £100,000, then the valuation would be £1,000,000 - this is one of the simpler methods. So the input for this is the EBITDA multiple.

- Discounted cashflow - This method takes each annual cashflow and "discounts" it back to a value today ("Present Value") and then adds all those cashflows up - so you need to input the "discount rate" which is basically the risk factor, the higher the discount factor, the higher risk factor, the lower the valuation.

- Terminal growth - The terminal growth rate is the constant rate at which a company is expected to grow forever. The reason is that this is needed is that the we need to have an understand of the value beyond the 5 year forecasts. This growth rate starts at the end of the last forecasted cash flow period in a discounted cash flow model and goes into perpetuity. A terminal growth rate is usually in line with the long-term inflation rate but not higher than the historical Gross Domestic Product (GDP) growth rate. We would normally suggest 1.0% to 1.5% but will depend on your specific business, stage and sector.

We cover valuations and their importance elsewhere in the guide, so please ensure you read up on them there!

💵Cash Management

The cash management inputs are crucial for understanding a company's liquidity, operational efficiency, and shareholder return strategy. Here's a summary of what each of these inputs means and their importance:

-

Days Receivable: This metric, also known as Days Sales Outstanding (DSO), indicates the average number of days it takes for a company to collect payment after making a sale. The lower the number of days the more efficient the business is at collecting cash owed to it.

-

Days Payable: Also known as Days Payable Outstanding (DPO), this measures the average time (in days) a company takes to pay its own bills and invoices. A higher DPO can be beneficial for cash flow management as it indicates that the company is able to retain cash longer, which can be used for other operational needs or investments. However, it's important to balance this with maintaining good relationships with suppliers.

-

% Annual Dividends: This represents the percentage of net income that the company pays out to its shareholders as dividends. A 10% dividend rate is quite significant and suggests that the company is committed to returning a substantial portion of its profits to shareholders. This can be attractive to investors seeking regular income. However, it also implies that the company is choosing to distribute these funds rather than reinvesting them back into the business for growth or debt reduction.

That's it! 👍💥 once you have done this we can head straight over to the Financial Model Calculations.