Model Outputs - Funding

📗Importance of this section

In this section, we have outputs that are at the investment round level (so dependent on the inputs on size, structure and timing of funding) and we have annual assumptions running over the forecast period. This output section gives you an idea of the funding that you require to deliver your plan and this is simply driven by assessing the shortfall in cash that the calculations show. If you are never short of cash then the model will show that you do not actually need any funding.

Funding Summary

This

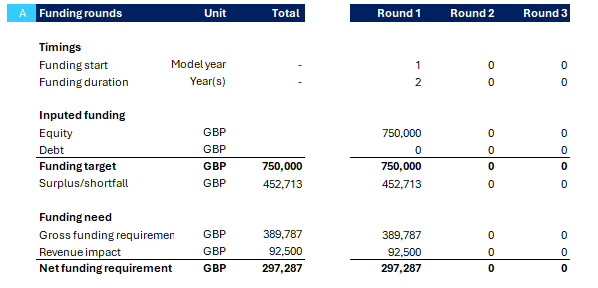

Funding Rounds

This section allows you to map out your fundraise across the forecast period. In this one page financial model, you have the ability to forecast three different funding rounds which can be made-up of any combination of equity and debt based on your inputs. You also input your target funding need and the model will show you whether this is above or below what you actually need based on all the inputs. It will then give you a gross and net funding requirement which is the funding that you need.

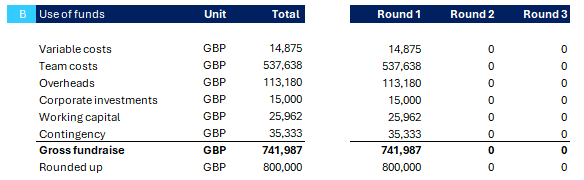

🙌 Use of Funds

This section is very important when it comes to pitch decks and discussing investment with investors - this is the "need". It shows you what you will spend the funding on across six core cost buckets - note this is based on the gross funding need. We would suggest to always have a contingency as this just mitigates any risk from the plan.

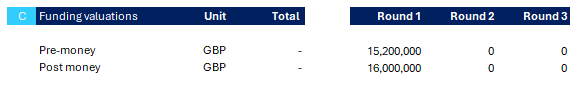

🙌 Funding Valuations

This section shows you the different valuations of your company at each investment round. We've split this out and "pre" and "post" money valuations (to understand what these concepts are please refer to the financial glossary that comes with this financial model) - the key here is that each funding round should show an increase in valuation showing that you are progressing, growing and hiting your milestones.

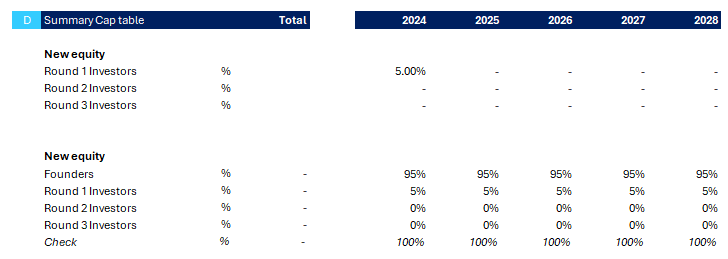

🙌 Summary Cap Table

This section is the cap table it shows the structure of the equity in the business and will show your dilution at each funding round and ultimately who owns what % of the company throughout the forecast period - this is important as the equity will dictate the returns that you as founders and your investors make.

🙌 Investor Returns

This is the all important section showing the investor forecasted returns that they may make. We look at this on a rolling basis on across the forecast period This means that we show the returns as if there was an "exit event" each and what that would mean to the founders and investors. You can select which valuation methodology to use (DCF valuation or EBITDA multiple) and the model will show the absolute returns your funder makes and the the "money multiple" which is the number of times that the returns exceeds the investment made and finally you will also see a return on investment you can see this based on each year and for each investor of each round.

OK so now you can dazzle 😵💫 an investor / or budget holder of your great idea and how it is ultimately is a money maker!